THE AVERAGE READING AGE FOR AMERICAN ADULTS IS 7th to 8th GRADE

The corporate world is taught to write articles for the average reading level of American adults, which is equivalent to the 7th to 8th grade, per a 2021 determination. [2] That corresponds to a reading level of a 12 year old to 13 year old child.

But how is it that "the greatest country in the world", "the most powerful country in the world", and the "richest country in the world" has an adult population that can't read better than a 13 year old child on average?

That should shock every American handing over 25% of their paycheck to the failed billionaire corporate welfare system and to the foreign aid welfare system, while non-millionaire Americans rot on our streets and in our bushes.

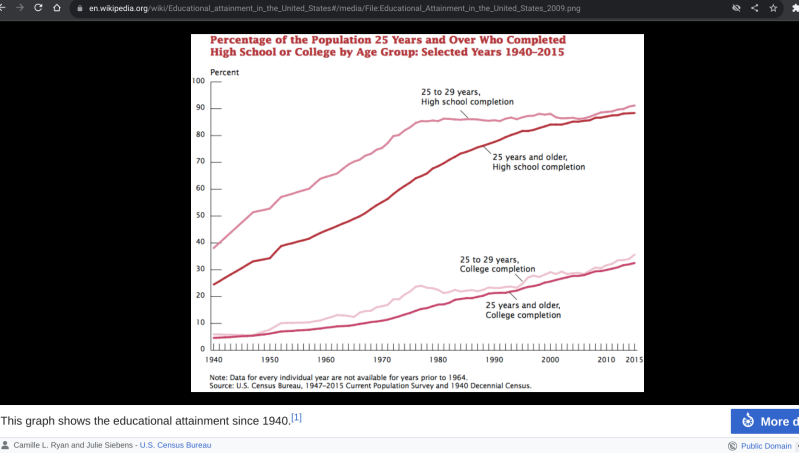

What's even more shocking per a 2015 summary of Census, is that we've never been more intelligence since the 1940s, below, and where around WWII, about 25% of the population completed high school, and only about 5% completed college, which is ripe pickings for organized crime and corrupt public offices, because when people are as educated as small children, organized crime and corrupt public offices can rob them blind, and get them to agree to the some to all of the same, by feeding them lie after lie, because uneducated people fail to develop logic, reasoning, and critical thinking skills and fail to abundantly work on research projects, which requiring researching things known as facts.[3]

Creating barriers to education by creating ranking systems and only providing free education to those who test in only limited types of intelligence, for example IQ testing (which only tests for three types of many more different types of intelligence), leaves most everyone else who doesn't receive a top score in this three types of intelligence, having to pay for higher education on their own, locking most others in positions of debt for years to life, resulting in their economic slavery.

THE ECONOMIC SLAVERY OF THOSE WHO DO AND DON'T PURSUE ADDITIONAL EDUCATION

According to Bill Fay, at www.debt.org, "The famed patriot Patrick Henry proclaimed “Give me liberty … or give me death!” at America’s founding.

As the country emerges from the COVID-19 pandemic, Americans’ motto has changed to “Forget financial liberty … give me debt!”

American household debt hit a record $16.9 trillion at the end of 2022, up $2.75 trillion since 2019, according to the Federal Reserve. If you had to write that check it would read $16,960,000,000,000.

Americans owe $986 billion on credit cards, surpassing the pre-pandemic high of $927 billion. We owe $11.92 trillion on mortgages, $1.55 trillion on vehicle loans and $1.60 trillion for student loans.

With average consumer debt in America on the rise, it’s no surprise that debt delinquency – missed payments of 30 days or more – has increased for nearly all debt types.

Even with that $16.9 trillion shared by about 340 million people, consumer debt statistics show that Americans are feeling the pain.

Who is most likely to get into debt? More importantly, who is most likely to get out of debt? Age, income, ethnicity, family type and education all play apart. Demographics, however, don’t strictly determine debt risk.

Understanding debt statistics and what’s behind them will help you manage your finances, get out of debt and find financial liberty. To get you started, here’s a look at debt statistics in America.

Inflation and Supply Chain Issues

Supply chain issues began during the earliest days of the COVID-19 pandemic. A shortage of workers, restricted work hours, and companies closing (either temporarily or for good), meant less “supply.”

In other words, fewer goods available. Lack of supply created a domino effect that continues to cause issues with the economy.

A major issue resulting in a large part from supply chain issues was inflation. When prices for goods rise rapidly, it costs more to get through the day, feed your family, pay for heat and electricity, and more.

Obviously, inflation and supply chain shortages have a big impact on household debt. The impact comes from both ends – cars, houses, and other big-ticket items are more expensive, making loans to buy them cost more. The other impact is that the more everyday things like food and clothes cost, the more people have to turn to credit cards.

Inflation peaked at 8% in the summer of 2022, a 40-year high. While it is slowly easing, the ripple effect on the average consumer’s budget continues.

When the amount American consumers owe for auto loans and mortgages began to level off, the amount they owed on credit cards spiked. Delinquency rates dipped during the COVID-19 pandemic, but by the end of 2022, about 2.5% of American debt was in delinquency, climbing toward the 4.7% it had been just before the pandemic hit.

Average American Debt by Age

While anyone can get into debt and have trouble paying their bills, the latest American debt statistics show that younger people are falling behind faster and going into delinquency, particularly on credit cards and auto loans.

Younger borrowers have surpassed pre-pandemic rates on delinquency. Delinquency rates for older borrowers are rising, but haven’t reached pre-pandemic levels.

Here’s a look at how much nonmortgage debt Americans have by age group, and the average non-mortgage per capita debt for each group:

- 18-29-year-olds: $69 billion total, $12,871 average

- 30-39-year-olds: $1.17 trillion, $26,532 average

- 40-49-year-olds: $1.13 trillion $27,838 average

- 50-59-year-olds: $98 billion, $23,719 average

- 60-69-year-olds: $64 billion, $16,661 average

- 70 and older: $36 billion $9,827 average

Average Debt to Income Ratios

Debt to income ratio is a key indicator of financial health. It’s determined by taking your monthly expenditures and dividing that number by your monthly income.

For instance, if your bills amount to $5,000 a month and you make $7,500 a month, your DTI is 66%. It also means you are dire need of financial overhaul.

The maximum DTI to qualify for a mortgage is usually 43%. Most financial advisors recommend keeping your DTI at 30% or lower.

The median household income as estimated by the U.S. Department of Housing and Urban Development was $90,000 in 2022. That’s for a household. The median individual income in for Americans in 2022 was $56,368. Median means that half had a higher income, half had a lower income. The average American household debt load, including mortgage, is $101,915.

Year-to-year DTI statistics are hard to come by, but given the rise of debt versus the rise in income, it’s apparent that Americans in all demographic groups have higher debt-to-income ratios.

Credit Card Debt and Income

The wealthier you are, the more likely you will carry debt. Of course, the wealthier you are, the easier it is to erase that debt. The lower your income, the more of it goes to paying debt.

The median income for the top 1% in the U.S. in 2022 was $570,003; the top 10% made a median $212,110; the lowest 25% made $34,429 and the lowest 10% made $15,640.

An Annuity.org study found that, when comparing income to debt and using the $570,003 figure as 100%, the following is true:

- Those earning less than 20% paid 26.11% of income toward debt

- 20%-39% paid 11.98% of income toward debt

- 40%-59% paid 7.33% of income toward debt

- 60%-79% paid 6.45% of income toward debt

- 80%-89% paid 5.95% of income toward debt

- 90%-100% paid 4.31% of income toward debt

Debt and Family Type

U.S. consumers with children have from 14%-51% more total debt than the national average, and their credit scores are lower than the national average, a study by credit reporting agency Experian found.

The study found that families with four or more children had 51% more than the national average in debt. The number decreased slightly as number of children decrease, but even one child will put a family 14% over the national average.

The study found that debt balances for credit cards and auto loans rose exponentially with the number of children. The one category in which balances didn’t increase was student loans, the premise being that by the time people are having kids, most of them are done paying for an education.

That said, everyone’s financial situation is different. The single guy next door may work 16 hours a day, have huge student loan payments and struggle to keep up with bills. The family with four kids on the other side may be high earners with wealthy backgrounds who didn’t have to take out student loans and pay off their credit card balances every month. You never know.

Though it does make sense that the more non-earning people in a home (namely, children), the more expenses the home will have. The more earning people (a couple vs. a single person), the more income there will be to pay bills and shoulder the mortgage together.

» Learn More: Financial Assistance for Single Parents

Debt and Race

Credit scores and credit history have a big impact on what’s available for American consumers to borrow, and how much that loan will cost. Numerous studies have found there are racial disparities in lending, credit reporting and scoring that end up being a catch-22 for Black and Hispanic borrowers. Having a mortgage and credit helps build a credit history that allows more favorable borrowing. If you can’t get credit, you can’t build the history.

Black and Hispanic borrowers on average have lower credit scores than white consumers, so their choices are limited. It’s even worse for Native American borrowers, who are largely credit invisible, a study by the Urban Institute found.

The average credit card balance for white families was $6,940 in 2021, the most recent figures available that break debt down by race. For Black families, it was $3,940, and for Hispanic families it was $5,510.

But the median debt-to-asset ratio for white families is 26.5%, while it was 46.8% for Black families, 46.2% for Hispanic families and 37.3% for other non-white races and ethnicities, an Employment Benefits Institute study found.

Assets include income, property and other elements that form a family’s wealth. Earlier we talked about debt-to-income ratio. Debt-to-asset ratio is similar, but also takes into account property, which can be used to enhance wealth.

A higher a debt-to-asset ratio has the same impact a lower credit score has on borrowing, meaning there are fewer options, and what’s available often is more expensive.

In 2021, the median income for white (non-Hispanic) households was $77,999, for Black households, it was $48,297; for Latino households, it was $57,981, and for Asian households it was $101,418.

Mortgages and Race

When it comes to mortgages, the median amount was $130,000 for white borrowers, $116,000 for Black borrowers and $130,000 for Hispanic borrowers, according to the Aspen Institute. The amount owed, though, doesn’t tell the whole story. Black, Latino, and Native American homeowners have mortgages that are often higher-cost and risker than those made to white borrowers, because they are based on assets, credit history and other factors. While white households borrow more heavily, they also have higher incomes, which means it’s easier to pay the larger loans, the study said.

That’s when non-white households can get a mortgage. While lenders can’t legally deny applicants on the basis of race, they use factors like credit score to deny more applications for Black, Hispanic and Native borrowers than for white borrowers, the Urban Institute found.

Student Loans and Race

Student loan debt also disproportionately affects people of color. An Investopedia analysis determined that among populations, Black, Hispanic, and Native American borrowers generally had higher unmet financial needs, incurred more student loan debt, and were more likely to struggle financially to stay in school. Black, Hispanic and Native American students most borrow more money to go to school, get less favorable rates, and owe more when they get out. As we explore later in this article, student loan debt can have a long-term impact on financial health.

Some statistics on race and student loans from educationdata.org:

- American Indian and Alaska Native student borrowers are the most likely to have payments of $350 a month or more, and pay an average $247 a month

- Black and African American student borrowers are the second-most likely to have monthly payments of $350 or more and pay an average $289 a month

- Asian student borrowers pay an average $272 a month

- White student borrowers pay an average $229 a month

- Black degree holders have an average of $27,260 in undergraduate student debt; Hispanic borrowers $25,676, Asian borrowers $25,670, white borrowers $21,578, Native American borrowers $23,343.

Debt and Gender

Women have made huge economic gains over the decades, but most have more debt than men. In 2022, women earned 82.9 cents for every dollar earned by men, according to the U.S. Bureau of Labor Statistics.

The median full-time yearly wage for men in 2022 was $61,152; for women, $50,700.

Many factors contribute to the gender wage gap, including discrimination in pay, recruitment, job assignment and promotion; lower earnings in occupations mainly done by women; and women’s disproportionate share of time spent on family care, according to the Institute for Women’s Policy Research.

Women over 65 also lag when it comes to retirement income and savings. About 50% of women ages 55-66 have no personal retirement savings, compared to 47% of men, according to the U.S. Census.

The gender wage gap has an impact on women’s debt. For instance, women and men owe a similar average in credit cards, $6,232 for women, $6,357 for men, according to Experian. Women also owe an average $192,368 for mortgages, compared to $211,034 for men.

Overall, Experian found men have more debt than women, including:

• 2% more credit card debt

• 20% more personal loan debt

• 16.3% more auto loan debt

• 9.7% more mortgage debt

But more debt doesn’t mean men’s debt burden is greater. More women report carrying unmanageable levels of debt than men (39% versus 31%), because women have lower incomes and are more often responsible for caring for children as a single parent, the Financial Health Network found. That statistic is even higher for Black women, of whom 51% report unmanageable debt.

Some 44% of women 18-29 said debt has led them to delay buying a home, getting married, having children, or making other life adjustments, as opposed to 34% of men in the same age bracket.

Women start life after college in a deeper financial hole than men, holding 58% of student loan debt. Borrowers who identify as LGBTQ also start out at a debt disadvantage, with an average of $16,000 more in student loan debt than those who do not.

Women are also more likely than men to make high monthly student loan payments despite having a lower income, and take an average of two years longer to pay off their loans, according to the National Center for Education Studies. NCES also found that women are more likely to take out loans for themselves, with parents more likely to take out student loans on behalf of a son than a daughter.

In the Financial Health Network study, 33% of women with household student debt said they are “very concerned” about their ability to pay off debt, compared with 18% of men.

Credit Card Debt

Credit card debt is one thing nearly all Americans share, regardless of race, gender or income level. It’s the most common type of debt in the U.S. By the end of 2022, Americans owed an all-time high of $986 billion on credit cards, a $130 billion increase in 12 months.

Credit limits were at an all-time high $4.39 trillion at the end of 2022, so, credit card holders still had $3.41 trillion in available credit. While that may seem like good news – consumers are using some restraint – credit card delinquencies also started to climb after dipping during the pandemic.

Credit Card Delinquency

Delinquency rates were up .06 percentage points in the last quarter of 2022. It may seem like a small amount, but it is part of a steady climb. While the number of delinquencies was lower than in 2019, there were more borrowers in delinquency at the end of 2022. Some 18.3 million people were behind on a credit card at the end of 2022 compared to 15.8 million at the end of 2019, the New York Fed reported.

While delinquency is inching up for all age groups, the rate of a credit card account transitioning into serious delinquency (90 days or more behind on payments) is particularly high for young borrowers, surpassing its pre-pandemic serious delinquency rate.

Percentage of accounts transitioning into serious delinquency in the fourth quarter of 2022:

- 18-29 age group: 7.6%

- 30-39 age group: 5.69%

- 40-49 age group: 3.81%

- 50-59 age group: 2.98%

- 60-69 age group: 2.81%

- 70 and older: 3.49%

Credit Card Balances by Age

Credit card debt is spread across all generations, with younger Americans having the smallest share of the total:

- 18-29 age group: $80 billion

- 30-39 age group: $1.9 trillion

- 40-49 age group: $2.2 trillion

- 50-59 age group: $2.2 trillion

- 60-69 age group: $1.7 trillion

- 70-plus: $1.2 trillion

Auto Loan Debt

Americans owed $1.5 trillion in auto loans at the end of 2022, an all-time high and an increase of $94 billion from the end of 2021. It’s a number that’s been going up since 2011, but has sharply increased in recent years.

The average loan increased from $17,000, in 2019 to $24,000 in the fourth quarter of 2022.

The percentage of drivers in an age group with auto loans, and average monthly payment for auto debt, according to Experian:

- Gen Z (up to age 26): 20.8% have no loan, 72.4% have one loan, 6.3% have two loans; average monthly payment is $429

- Millennials (27-42): 36.8% have no auto loan, 52.9% have one, 9.3% have two; average monthly payment is $547

- Gen X (43-58): 38.8% no auto loans, 45.9% have one, 12.6% have two; average monthly payment $637

- Baby Boomers (59-77): 49.9% no auto loan, 40.3% have one, 8.3% have two; average monthly payment, $570

- Silent Generation (age 78 and up): 65.7% no auto loan, 30.6% one loan, 3.3% two loans; average monthly payment, $477

Medical Loan Debt

There is more than $88 billion in medical debt on consumer credit reports, according to the Consumer Financial Protection Bureau. The bureau said the number is likely much higher, because there is no central reporting platform to measure the debt.

Black and Hispanic people, young adults and elderly ones, veterans and low-income Americans are more likely to have medical debt, according to the CFPB.

Medical bills that aren’t paid and go into collections and appear on a credit report will hurt the person’s access to credit, drive up prices of credit they can get and increase the likelihood of bankruptcy. A CFPB study found that 25.8% of people with medical debt reported “low or very low levels of financial well-being” related to the debt. Percentage of those with medical debt concerned about financial health, by income:

- $15,000 or less: 39.2%

- $15,000-$34,999: 40.2%

- $35,000-$49,999: 27.4%

- $50,000-$74,999: 20.4%

- $75,000-$99,999: 20.1%

- $100,000-$149,999: 15.6%

- $150,000-$199,999: 16.1%

- $200,000 and up: 22%

Student Loan Debt

Paying for college is a long-term burden for millions of Americans. Student loan debt accounted for $1.6 trillion of America’s debt load by March 2023, according to the Federal Reserve. That’s more than double what it was a decade earlier.

The average balance owed on a federal student loan is $37,574, and the average balance on a private loan is $39,590.

Some student loan debt statistics:

- 20% of American adults have undergraduate student loan debt

- 7% of American adults have postgraduate student loan debt

- 58% of adults 18-29 years have student loan debt.

- 60% of adults 30-49 have student loan debt.

- By age 30, 37% of associate degree holders and 21% of bachelor’s degree holders have been delinquent in student loan payments at least once.

Student Loans and Credit Card Debt

The more education someone has, the more overall debt they’re likely to have, because they have access to more options. But they also make more money. The highest earners have a credit card debt to income ratio of 9.1%, while lower earners are closer to 10%. People who go to college but don’t graduate and are paying student loans without the benefit of the earning power than comes with a degree have a 13.8% credit card debt-to-income ratio.

People with college degrees have an average of $8,200 in credit card debt. Those who attended college but did not graduate have $4,700, and high school only graduates have an average of $4,600, according to data from the Federal Reserve, the Consumer Financial Protection Bureau and Experian.

Student Loans and Earning Potential

A person’s education level directly affects their earning potential.

Here is the U.S. Census Bureau’s most recent look at median annual income by education level:

- No high school diploma: $30,378

- High school or equivalent: $50,401

- Some college, including associate degree: $64,378

- Bachelor’s degree or more: $115,456

In general, people who earn a degree make an average of 71% more money than peers with only high school diplomas, according to the Census Bureau.

Student Loan Forgiveness

Federal student loans were granted forbearance in 2020 because of the COVID-19 shutdown. In March 2023, the U.S. Supreme Court took up the Biden administration’s proposed loan forgiveness plan. The forbearance plan has stayed in place in the years that the forgiveness plan has been debated. If it isn’t shot down, it would cancel roughly $1 trillion in student debt, up to $50,000 per person.

The Pandemic Impact on Debt

The less your income, the easier it is to pile up debt. That obvious lesson hit home in 2020, when the unemployment rate went from 3.5% pre-COVID to a peak of 14.8% in April 2020 — the highest level since 1948. The total U.S. consumer debt balance grew $800 billion, according to Experian. That was an increase of 6% over 2019, the highest annual growth jump in over a decade.

Student loan debt, mortgage debt and personal loan debt all went up. Credit card debt, however, dropped $73 billion, a 9% decrease from 2019 and the first annual drop in eight years. Federal aid programs, mortgage forbearance, emergency rent programs and student loan forbearance all helped ease the debt load that was building.

In 2022, with emergency programs over, supply chain shortages still an issue and inflation on the rise, American debt statistics showed things had changed in two years and overall balances were $2.75 trillion higher than at the end of 2019.

Mortgage balances were $11.92 trillion at the end of 2022, a nearly $1 trillion increase in a year, with $126 billion of that non-housing balances.

Credit card balances, at $986 billion, soared past the pre-pandemic high of $927 billion.

Auto loan balances, at $1.5 trillion at the end of 2022, were up significantly from the $1.33 trillion they were at the end of 2019."[4]

Accordingly, those people who tried to better themselves in life by increasing their access to higher education, resulted in having significantly more debt than those who didn't, and 29% of those people with more debt about 1/3 didn't make more money than someone with a high school diploma.

So Americans who learn more about how ongoing organized crime and corrupted public offices rip off everyone else to feed the corporate welfare system and failed billionaire experiment are literally punished with more economic slavery than those who don't try and learn more about how the world works.

Think about that for a moment, the more education or knowledge you have, the more you need to be forced into economic slavery, which is why ignorance is bliss. The less you know, the less you have to worry about all the things really educated people learn about. And if they try and educate you, they are the ones being unreasonable, because their ideas are in contrast to what you learn on TV, making those trying to save you "radicals".

THE CRIMINAL RULING ELITE OF JEFFREY EPSTEIN'S ORGANIZED CRIME SYNDICATE DIVIDE AND CONQUER USING CLASS WARFARE, BASED ON THE PORTION OF THE UNEDUCATED LOWER CLASS THEY CAN KEEP UNEDUCATED TO BE ABLE TO POLARIZE AGAINST THE MORE EDUCATED MIDDLE CLASS TRYING TO SAVE THEM FROM THE CRIMINAL RULING ELITE: THE RACE AND INFO WARS BETWEEN THE CRIMINAL RULING ELITE SPEWING LIES TO ENSLAVE AND THE MIDDLE CLASS PREACHING THE TRUTH

And so why is it important to organized crime, the failed billionaire experiment of Jeffrey Epstein, and the public offices they bribe and corrupt to keep most of the country at a 7th grade to 8th grade reading level? Because then they get to use their corporate media to lie to you, so that you will believe BIG LIES are the truth, and so that you will believe the truth are BIG LIES.

As we have addressed in other articles, this also allows a minority ruling class, which former prosecutor Glenn Kirschner refers to as the criminal ruling elite, to subject you to not just lies, but to Russian or fake royal active measures, which polarizes natural differences in every population against one another to get the uneducated lower class, to literally attack the more educated middle class, who has access to the criminal ruling elite, and who knows their criminal secrets, and who try to teach the uneducated lower class the same, in a bid to unite the lower and middle classes together.

However, the criminal ruling elite has control over what the uneducated lower class believes is true, because the uneducated lower class hasn't gone to school, isn't trained to research the truth, and so the only information they have access to, is largely owned and fed to them by the failed billionaire experiment of Jeffrey Epstein, who lies to them to get them to attack the middle class, who is trying to unite the lower and the middle classes together, but competing with the louder lies of the criminal elite's corporate media also competing to unite the uneducated lower class to criminal ruling elite.

The reason for all of this as addressed in many of our other articles is that the criminal ruling class only makes up 0.001% of the total population, which means that they need to divide and conquer the 99.999% of the non-millionaire class, and they target the uneducated lower class, whose intellect may be close to their 12 year old to 13 year old or 7th grade to 8th grade reading level.

And so just like a 12 year old or 13 year old, the uneducated lower class is threatened by those who seem to know more than they do, which the criminal ruling elite know well, and so they use active measures by getting people of different religions to hate one another, and by getting people of different genders and sexual preferences to hate one another, and by getting people of different ethnicities and races to hate one another, and by getting people who vote for different parties to hate one another, and they get people of different ages to hate one another, and they get people of different incomes to hate one another, and then they use that hate to conquer and divide the uneducated lower class of the 99.9% of non-millionaires to get them enraged enough to get them to overthrow the more educated middle class, because the lower class can rarely access the criminal ruling elite in their fortresses with their private armies, et cetera, and so the only people the uneducated lower class can access is the middle class trying to teach them about the ongoing organized crimes of the criminal ruling elite or billionaire class.

This is why it is important to the criminal ruling class and the public offices they corrupt to burn certain books, to ban certain books and lines of study (for example Ron DeSantis), and to vilify certain news outlets, and why they stalk, entrap, wrongfully prosecute, wrongfully convict, toggle, filter, and discredit U.S. law enforcement, U.S. lawmakers, intelligence community members, university professors, journalists, whistleblowers, activists, and anyone else trying to teach the uneducated lower class about how the criminal ruling elite is harming them and the middle class -- as Donor's Trust's Project Veritas and Turning Point USA have done -- and where they have also infiltrated schools to be able to pit the children of the uneducated lower class against the children of the educated middle class, to literally engineer class warfare beginning as the age when kids start to develop their own opinions, literally class warfare of the failed billionaire experiment meant to defend the criminal ruling class in the future for their future crimes.

Because if the lower class and middle class united instead of allowing themselves to be divided by the corporate media of the failed billionaire experiment of Jeffrey Epstein, then they would so far outnumber the criminal ruling elite, that they could do away with them in a day, or by the next election, by simply electing those who tax the criminal ruling elite 99% wealth tax, and/or they could prosecute the criminal ruling elite for decades of organized crimes harming the lower and middle classes.

More simply, there are barriers to education so that the criminal ruling elite can manufacture the "critical mass" to be elected, to steal elections, and/or to overthrow the country for them to both remain in power and expand their ongoing organized crime syndicate, but also for them to evade criminal justice and/or civil liability for the same.

As long as the criminal ruling elite can keep some part of the population uneducated enough to believe their BIG LIES, they can incite that part of the population against those trying to save them, the middle class, to keep the criminal ruling elite in power to be able to continue their ongoing organized crimes.

IQ BY STATE REVEALS THAT PEOPLE IN THE SOUTH ARE BEING ROBBED OF THEIR EDUCATION, WHICH IS IMPORTANT, BECAUSE THAT IS WHO CORPORATE MEDIA SEEKS TO POLARIZE TO OVERTHROW THE MIDDLE CLASS TO KEEP THE LOWER AND MIDDLE CLASSES OPPRESSED, EXPLOITED, AND PAYING THE CORPORATE WELFARE TO EPSTEIN'S FAILED BILLIONAIRE EXPERIMENT AND CRIMINAL RULING ELITE

The following link to the 2023 IQ ratings by U.S. state reveal the following clear pattern. There is a clear IQ difference between the Northern states and the Southern states, with the Northern states having clearly a much higher IQ than the lower states.

The Northwest has the highest IQs, followed by the Northeast, followed by the North Central/Great Plains region of the United States. The entire South has a much lower IQ score across the board, and this is important because this is Russia's and Jeffrey Epstein's Republican base.

Accordingly, Russia's and Jeffrey Epstein's GOP robs the South of their educational potential -- and in doing so keeps them uneducated, and then their corporate media, for example but not limited to Jeffrey Epstein's Trump's "truth" social, and/or Jeffrey Epstein's Rupert Murdoch's Fox News, becomes the "truth" for these poor people, who the rest of America keeps trying to save from this criminal ruling elite of Jeffrey Epstein, but the criminal ruling elite is literally telling Russia's and Jeffrey Epstein's Republican base the opposite of the truth, desperate not to lose the "critical mass" the 0.001% of America's population has manufactured with BIG LIES, in order to (1) keep the illegitimately installed government employees and changes they made after 2016 in place, (2) to obstruct justice for the criminal ruling elite's victims, (3) to allow the criminal ruling elite to remain in power over the 99.9% of non-millionaires, (4), and to allow the criminal ruling to expand their rights, wealth, power, and influence over the 99.9% of Americans, by taking their rights, wealth, power, and influence away from them.

UpRights News is resisting the same by uniting the left and the Christian right against Jeffrey Epstein's billionaires' fight.

As H.G. Wells once said, "Civilization is in a race between education and catastrophe. Let us learn the truth and spread it as far and wide as our circumstances allow. For the truth is the greatest weapon we have."[5]